The world’s most influential companies could collectively mobilise at least $1.3 trillion into low-carbon investments to support the global transition to net-zero emissions, according to new analysis published by the World Benchmarking Alliance (WBA).

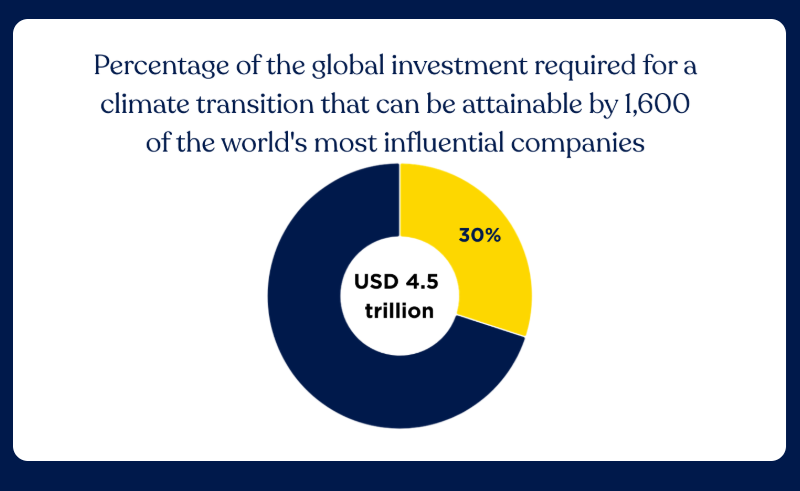

The figure represents around 30% of the annual clean-energy investment required to remain on a 1.5°C-aligned pathway, underlining the scale of impact corporate capital allocation could have on climate action, long-term business resilience and global economic stability.

WBA’s most comprehensive global assessment to date, covering 2,000 of the world’s most influential companies, finds that while large-scale spending on low-carbon technologies remains uncommon, momentum is building. Around 25% of companies across multiple industries now report investments in low-carbon solutions, with many allocating well above the 7% median share of total capital expenditure.

These investments are flowing into established technologies such as electrified transport, green ammonia and fertilisers, battery manufacturing, renewable energy, regenerative agriculture and low-carbon construction materials. WBA also identified leading companies across 19 industries that are directing up to 30% of capital expenditure towards climate solutions, while actively shifting investment away from high-emission activities such as new combustion engine development and carbon-intensive construction.

“This research shows a striking diversity in performance,” said Gerbrand Haverkamp, Executive Director of the World Benchmarking Alliance.

“While some companies are making impressive progress, too many continue to fall behind. In the midst of rising climate impacts, geopolitical tensions and economic uncertainty, companies still have a choice in how they respond. Our data makes it clear that progress is possible, and a growing group of companies are proving that meaningful action can be taken today. But we also see signs of hesitation, with some companies backsliding or stagnating. That is why it is essential to look beyond corporate commitments and focus on actual emissions and investments.”

According to the analysis, if more companies replicated and scaled these existing investment approaches, at least $1.3 trillion could be redirected towards clean-energy and climate solutions. Such a shift would significantly accelerate corporate progress towards 1.5°C-aligned pathways and help limit the scale and duration of any temporary overshoot of the temperature threshold.

The urgency is underscored by the sheer influence of the companies assessed. Together, the 2,000 firms generate $53 trillion in annual revenues, account for over 55% of global emissions, and employ 107 million people directly, with a further 550 million working across their value and supply chains. Yet despite signs of increased low-carbon investment, only 18% of companies are reducing operational emissions at the pace required to meet their sector-specific 1.5°C pathways.

WBA warns that this gap represents a critical missed opportunity, noting that delaying action will require far steeper and more costly emissions reductions later, given the cumulative nature of greenhouse gas emissions.

Nature and biodiversity risks remain largely overlooked

The assessment also highlights major gaps in how companies address nature-related risks. While 85% of companies assessed assign sustainability oversight to senior leadership or boards — signalling stronger governance — understanding of biodiversity dependencies remains limited.

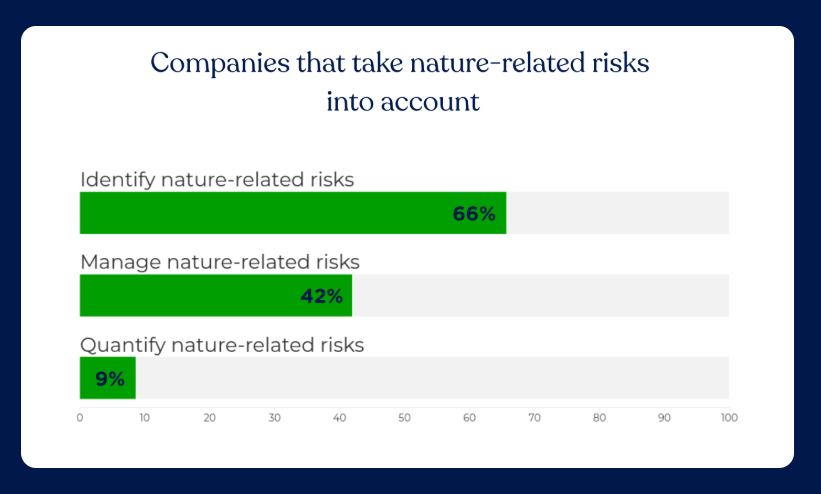

Among the 750 largest companies operating in high-impact sectors such as food, mining and paper, only 14% measure their dependence on ecosystem services. Around 34% show evidence of managing nature-related risks, including through biodiversity assessments, water-reuse systems and regenerative agriculture. However, just 9% quantify the potential financial or operational impacts, and only 4% assess opportunities linked to healthier ecosystems.

Broader findings from the 2026 Benchmark Hub

Alongside its climate analysis, the 2026 Benchmark Hub sheds light on wider sustainability challenges across environmental, social and governance issues:

- Cost-of-living pressures: Corporate inaction on living wages and affordability continues to exacerbate financial strain on households globally, with fewer than 5% of major companies paying a living wage.

- Nature and biodiversity: Only 9% of firms quantify nature-related risks, leaving significant untapped opportunity for early movers to integrate natural capital into strategy and risk management.

- Human rights and supply chains: Fewer than 10% of companies assess human rights risks across their supply chains, and only one in five trace products to understand environmental impacts.

- Tech sector accountability: While 38% of major technology companies publish ethical AI principles, none disclose the results of human rights impact assessments, pointing to persistent accountability gaps.

WBA said the findings reinforce a central conclusion of its 2026 Benchmark Hub: the transition to a sustainable and resilient global economy depends heavily on decisive, scaled action by the world’s largest and most powerful companies — not only through commitments, but through measurable emissions reductions and capital allocation decisions.

Read the full report here.