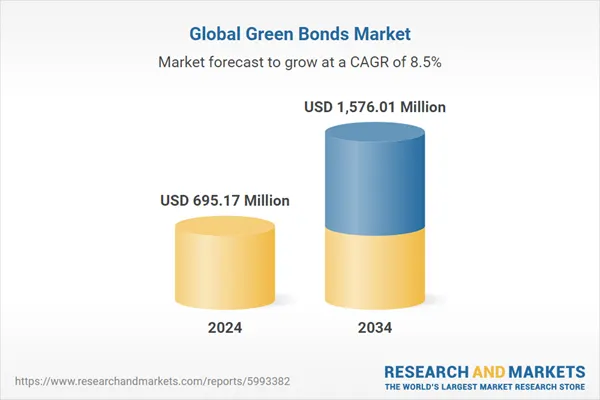

The Green Bonds Market is projected to reach a value of $695.17 million in 2024, with strong growth potential. By 2034, it is expected to expand to approximately $1.57 billion.

This forecast is detailed in the report “Green Bonds Market – A Global and Regional Analysis: Focus on Application, Product, and Region – Analysis and Forecast, 2024-2034” from ResearchAndMarkets.com.

As a key component of sustainable finance, the global green bond market is dedicated to funding projects that enhance environmental sustainability. Green bonds adhere to the Green Bond Principles (GBP), which guide the allocation of debt market funds to initiatives aimed at mitigating climate change, preserving natural resources, and boosting biodiversity. These principles emphasize transparency, disclosure, and reporting, helping issuers build sustainable business models through targeted environmental projects.

The report reveals that recent years have seen the expansion of green bond frameworks and standards, integrating more closely with Sustainable Development Goals (SDGs). This growth is supported by increasing regulatory backing and incentives promoting green financing. The market is aligning more with global sustainability objectives, creating a stronger connection between financial activities and environmental goals.

Key factors driving the green bond market include heightened transparency demands and the integration of sustainable practices across industries. Financial institutions and investors now require detailed environmental impact disclosures, improving the accountability of green bond issuances. Additionally, technological advancements are enhancing the tracking and reporting of environmental benefits, boosting investor confidence and participation in green finance.

These trends are creating substantial market opportunities. By aligning investments with SDGs, green bonds address critical environmental challenges while offering ethical investment options. As the market evolves, ongoing improvements in standards and increased global engagement are expected to drive significant growth, establishing green bonds as a vital element in the global effort towards environmental sustainability and economic resilience.