Companies of all sizes within the EcoVadis Network, particularly those with multiple ratings, are demonstrating notable progress across a wide range of sustainability challenges. These findings are detailed in the eighth edition of the Business Sustainability Index, released by EcoVadis, a leading provider of business sustainability ratings.

This edition of the Index delves into trends from over 125,000 supplier sustainability ratings (~38,000 in 2023 alone) provided to 1,200 prominent procurement teams between 2019 and 2023. It examines the performance of these suppliers, who represent various global regions and major industries, across four core assessment themes: Environment, Labour & Human Rights, Ethics, and Sustainable Procurement. The data-driven analysis offers insights into the current state of global value chains’ sustainability as we approach the midpoint of a crucial decade for climate and social action.

The score trends provide a perspective on how large purchasing organisations are utilising ratings within their supply chains to mitigate risks, enhance resilience, prepare for compliance with ESG reporting and due diligence regulations, and unlock the value necessary to succeed both now and in the future. They also illustrate how suppliers are reducing operational risks, improving efficiency, cutting costs, gathering better data, and strengthening their relationships with business partners.

For instance, companies with multiple ratings are generally outperforming regional and industry benchmarks. These organisations are establishing comprehensive policies, setting data-driven targets, adopting improved practices, reporting their progress to a broader audience, and extending their sustainability efforts to the next tier of the value chain.

The average score for companies on their first rating is 46.7, compared to 55.1 for those with multiple EcoVadis Ratings. Reassessed companies typically show score improvements of 8 to 10 points per theme, on average, compared to first-time-rated companies.

The “first rating baselines” reveal that significant work remains across value chains. In 2023, 42% of first-time rated suppliers were categorised in Insufficient/Partial performance levels, indicating substantial sustainability risks and ineffective management systems. The percentage of companies in high to medium risk ranges rises to 80% for the Sustainable Procurement theme.

Companies in the network show greater maturity in the Labour & Human Rights theme, with an average score of 54.6. Particularly, small companies have increased their average by 7.3 points since 2019. All industries have now surpassed the 50-point average score for this theme, with Finance, Legal & Consulting leading at 58.6.

However, most companies remain in the risk range for the Sustainable Procurement theme, with an average score of 41.2.

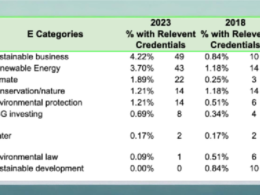

The global average score for the Environment theme increased by 2.1 points in 2023, the largest gain among all themes. Companies with multiple EcoVadis Ratings achieved an average score of 57.2, with nearly one-third performing at an Advanced level. However, there was a decline in performance within the Food and Beverage industry, where large companies saw a 2-point decrease since 2019.

“The Sustainable Procurement theme is becoming an even more crucial area to watch as supply chain and due diligence laws continue to expand,” said Sylvain Guyoton, chief rating officer at EcoVadis. “The principle of ‘substantiated concerns’ in the Corporate Sustainability Due Diligence Directive, for example, will require many companies to cascade sustainable procurement practices to their Tier 1 suppliers, and who may be anywhere in the world. Companies must work more closely with suppliers than ever before to remain both compliant and competitive.”