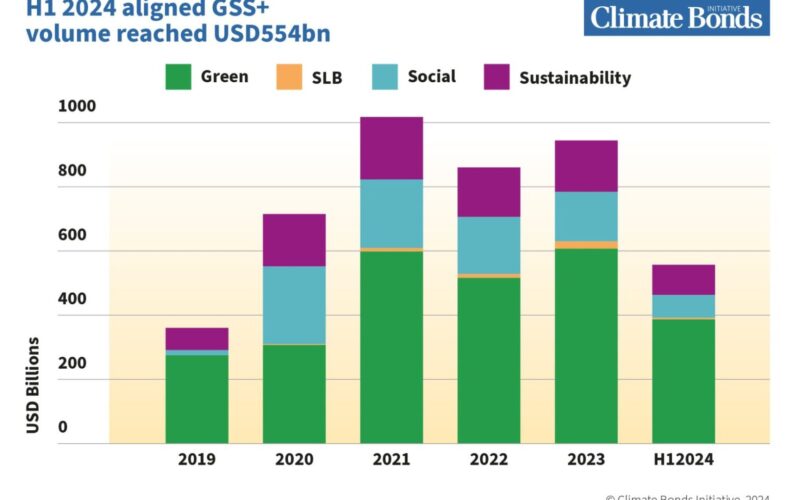

As of June 30, 2024, the Climate Bonds Initiative has recorded a cumulative total of $5.1 trillion in green, social, sustainability, sustainability-linked (SLBs), and transition bonds (collectively GSS+). These findings, aligned with Climate Bonds’ dataset methodologies and best practices, are detailed in the Sustainable Debt Market Summary for the first half of 2024, which also provides a breakdown of the labelled bond markets.

The global interest rates remained higher than initially expected for 2024. The global debt issuance reached $13.2 trillion during this period, a 35% increase compared to $9.8 trillion in H1 2023. The GSS+ market continues to flourish, with new issuers consistently entering the space, and volumes poised to exceed the annual record of $1 trillion set in 2021.

In H1 2024 alone, $554 billion of aligned GSS+ volume was recorded, a 7% year-on-year increase from H1 2023. Green bonds accounted for 70% of the total, reaching $385.1 billion, followed by sustainability bonds at $93.9 billion (17%) and social bonds at $70.5 billion (13%).

France, in its Olympic year, has emerged as a leader in sustainable finance. Since hosting the UN Climate Change Conference (COP21) in Paris in 2015, France’s sustainable finance policies have driven significant growth in its GSS+ market. By the end of H1 2024, France was the third-largest source of cumulative GSS+ issuance, with $542.9 billion, following supranational issuance ($763.2 billion) and the USA ($714.6 billion).

France also leads in aligned social bond issuance, with $216.2 billion by the end of H1, largely driven by its social security agency, CADES, which priced over $143.3 billion in social bonds, making it the largest issuer in this category. France’s momentum in the labelled bond market is setting it up for a record-breaking year in GSS+ volumes.

Since 2012, 22 additional French issuers have priced aligned social deals, starting with local government entities such as Île-de-France, Provence-Alpes-Côte d’Azur, and Hauts-de-France. In 2017, France became the first core sovereign to issue a green bond.

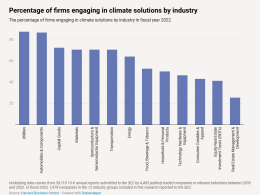

Climate Bonds’ review of the steel and cement sectors revealed two positive trends: an increase in green bond issuance from these industries and credible transition plans in place for most (57%) of the 21 companies assessed. Climate Bonds has introduced tools and guidance to further decarbonisation in hard-to-abate sectors, including sector-specific criteria and transition plan guidance. These efforts are part of its Certification program and GSS and SLB dataset assessments.

Additionally, Climate Bonds is developing a Transition Plan Monitor (TPM), which assesses the quality of entity-level transition plans, starting with the steel and cement sectors.