GlobeScan, a global insights and strategy consultancy, in collaboration with Robert Eccles, Alison Taylor, and Salesforce, recently published a report identifying gaps preventing sustainability from becoming central to corporate strategy. A number of interviews were conducted with senior professionals in finance, technology, and sustainability roles to identify key gaps.

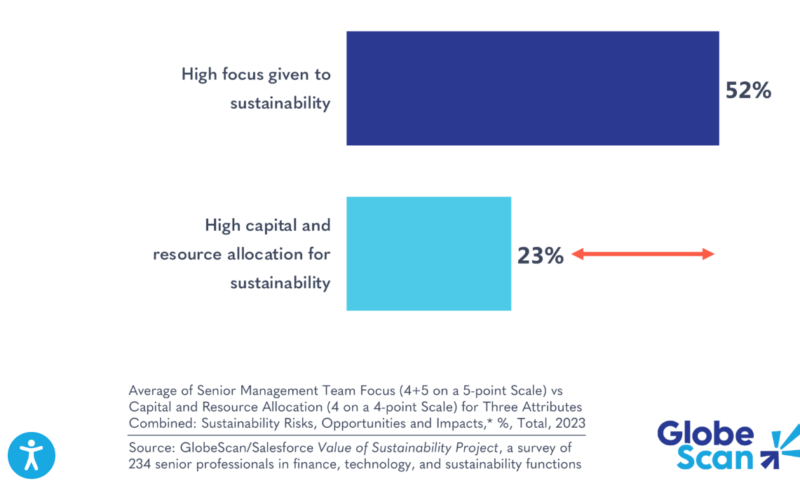

The most significant gap identified is in capital and resource allocation. While 52% of senior C-suite teams maintain a strong focus on sustainability risks, opportunities, and impacts, less than 23% of these teams are dedicating substantial capital to address these priorities. This discrepancy highlights the challenge—while many companies acknowledge the importance of sustainability, acting on it proves far more difficult.

The report also revealed that over 90% of respondents consider sustainability either “very important” (67%) or “fairly important” (26%) to commercial success. Despite this, while half of the senior management teams claim a high focus on sustainability issues, only about half of those efforts are backed by the necessary capital to mitigate risks, capitalise on opportunities, or manage impacts effectively.

Respondents believe sustainability adds the most value in areas like marketing and public relations, specifically in enhancing brand reputation, strengthening relationships with stakeholders and communities, and fostering partnerships. These focus areas, which are more about perception and less directly tied to financial outcomes, are often disconnected from core operations. Fewer respondents see sustainability contributing to commercial aspects of the business, such as increasing sales, attracting investments, stabilising supply chains, reducing costs, and managing climate risks. Since capital allocation typically revolves around these commercial areas, the slow progress in sustainability becomes more understandable.

When asked about the most impactful actions to unlock greater value from sustainability, respondents pointed to R&D and innovation as the primary opportunities, followed by engagement with customers and suppliers. For finance and technology leaders—more so than sustainability leaders—setting clear priorities, goals, and targets is essential, suggesting a gap in alignment and understanding that needs to be bridged.

Despite its recognised importance to commercial success, only 37% of respondents believe sustainability is “very integrated” into their core business. The low integration into key functions such as finance and technology limits the sustainability team’s ability to identify business opportunities. While these functions are critical for advancing sustainability efforts (86% for finance, 75% for technology), senior leaders report limited collaboration between them and the sustainability function. However, despite this low baseline, most respondents have observed increased collaboration over the past two years (70% with finance, 63% with technology).