Around 40% of development finance projects funded by China in the Philippines are linked to at least one form of environmental, social, or governance (ESG) risk, according to a study by US-based research firm AidData. The findings, presented during a media briefing, shed light on China’s economic and diplomatic activities in the Philippines over the past 20 years.

Samantha Custer, AidData’s Director of Policy Analysis, highlighted that a significant portion of Chinese-backed projects in the Philippines carry heightened risks in ESG categories. “Our assessment revealed that 40% of the China-financed projects in the Philippines have an elevated exposure to at least one type of risk—environmental, social, or governance,” Custer said.

The energy sector, in particular, was identified as the most vulnerable, with Chinese-funded projects displaying the highest levels of ESG risk. Environmental concerns were especially prominent, though the agriculture, forestry, and fishing sectors also faced increased risks across all ESG factors.

Custer noted that the lack of transparency surrounding Beijing’s terms for these projects poses additional financial risks, creating opportunities for corruption and collusion. “When large sums of money are involved with limited transparency, it increases fiduciary risks,” she added.

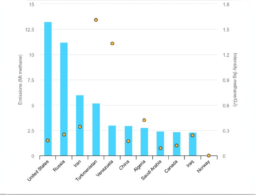

The report also revealed that China financed 233 projects in the Philippines between 2000 and 2022, valued at $9.1 billion, with 91% consisting of high-interest loans. Approximately 55% of these projects were executed by Chinese firms, often state-owned enterprises, some of which have been associated with elevated ESG risks or are under sanctions from institutions like the World Bank or Asian Development Bank.

While advising against completely cutting economic ties with China, Custer recommended the Philippines be cautious about the terms of such deals. “It’s not in the Philippines’ best interest to entirely decouple from China. Negotiating from a position of strength involves engaging with multiple partners, including the US, Australia, and China,” she explained. “The fewer players at the table, the more limited your options. The smartest approach is likely a hedging strategy.”