Amid an intensifying climate emergency and 2023 being recorded as the hottest year to date, corporate efforts to reduce carbon emissions have decelerated. A newly released study by Boston Consulting Group (BCG) and CO2 AI reveals that companies made little progress on climate action over the past year.

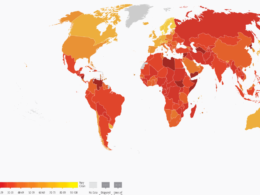

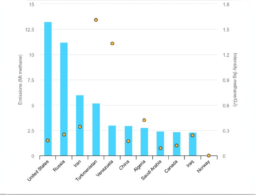

The findings come from the fourth edition of BCG and CO2 AI’s Carbon Emissions Survey, detailed in the report ‘Boosting Your Bottom Line Through Decarbonisation’. Surveying 1,864 executives responsible for emissions measurement, reporting, and reduction from 16 major industries across 26 countries, the study covers organisations representing roughly 45% of global greenhouse gas emissions. The companies surveyed have at least 1,000 employees and annual revenues ranging from $100 million to over $20 billion.

“This year’s survey highlights the substantial rewards some companies are reaping from decarbonisation, including significant financial gains, enhanced reputations, and operational efficiencies,” said Hubertus Meinecke, BCG’s global leader of climate and sustainability and a coauthor of the study.

“Too few companies are seizing the financial gains offered from decarbonisation,” said Diana Dimitrova, a BCG managing partner, director, and co-author of the study. “By mastering essential foundational actions like measurement, reporting, target setting, and taking advanced steps toward sustainability, these companies can become more efficient, more profitable, and demonstrate a stronger commitment to a greener future,” she added.

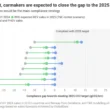

Among the nearly 2,000 companies surveyed in 2024, only 9% provided comprehensive reporting on Scopes 1, 2, and 3 emissions, with just 16% setting targets across all scopes, and 11% achieving emissions reductions aligned with their goals. These numbers reflect a decline from 2023.

Brazil, India, and China emerged as leaders in comprehensive emissions reporting, target setting, and achieving emissions reductions in line with their objectives.

Despite the overall slowdown, 25% of the companies surveyed reported annual decarbonisation benefits exceeding 7% of their revenues, with an average net gain of $200 million. These benefits were often driven by reduced operating costs, achieved through efficiency initiatives, waste reduction, and the use of renewable energy.

The report highlights that foundational actions—such as emissions measurement, reporting, and target setting—are critical to maximizing decarbonization benefits. Companies that excel in these areas are significantly more likely to see financial rewards. Comprehensive emissions measurement boosts the likelihood of significant benefits by 1.6 times, full reporting across all scopes increases the chances of major gains by 1.5 times and setting validated targets across scopes enhances the likelihood of financial benefits by 1.9 times.

In addition to foundational steps, advanced actions like using AI to optimise emissions reduction further amplify impact. Companies employing AI are 4.5 times more likely to achieve significant decarbonisation benefits, while those calculating product-level emissions are four times more likely to experience similar advantages. Implementing climate transition plans increases the likelihood of aligning with a 1.5°C pathway by 3.3 times.

“The window for companies to increase ambition and take decisive action to limit global warming to 1.5°C is rapidly narrowing, but AI has the potential to be a game changer, empowering businesses to reduce emissions and make meaningful strides toward mitigating climate change. Our research shows the need for companies to double down on using AI responsibly to make sure they can deliver their climate goals and bottom-line business targets,” said Charlotte Degot, CEO and founder of CO2 AI and a coauthor of the report.