Datamaran, an ESG risk assessment platform, has announced the successful completion of a $33 million Series-C financing round led by investment funds managed by Morgan Stanley Expansion Capital, further cementing its position as a global leader in the ESG software market. The funds will be used to accelerate the company’s expansion in the US and Europe, and to advance initiatives in generative AI.

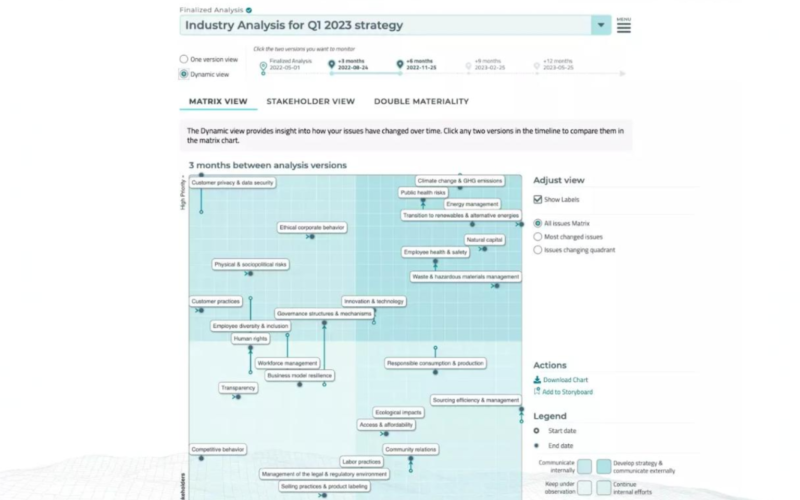

Over the past 18 months, Datamaran has more than doubled its subscription revenue, driven by rising demand from C-suite executives for its ESG governance and risk management solutions. The company’s platform allows clients to track over 400 external risk factors, transforming ESG compliance from a cost centre into a value-generating asset.

“As a 10-year-old company, we are the trailblazers in strategic ESG, and this investment will enable us to stay at the forefront of innovation in AI-powered software to serve our clients’ growing needs. With the number of ESG reporting requirements increasing exponentially, there is a clear incentive for companies to double down on ESG governance and know their material risks and opportunities,” said Marjella Lecourt-Alma, CEO and Co-founder of Datamaran.

Datamaran’s platform is used by nearly 200 clients, including major organisations such as Dell, Cisco, AB InBev, Deloitte, Pepsico, and EFRAG, helping them comply with over 4,000 ESG regulations globally. With a database of 9,000 companies, clients can benchmark themselves, set targets, and drive efficiency and profitability.

Lincoln Isetta, Managing Director of Morgan Stanley Expansion Capital said, “Datamaran has exhibited impressive growth and capital efficiency since we first met them over two years ago. They are a market leader in providing technology that enables companies to embed ESG into their business practices, which is becoming more important as customers, stakeholders and regulators demand ever greater accountability from global enterprises. We are excited to partner with Marjella and her team to support Datamaran’s next stage of growth, penetrating further into the U.S. market and seeking to add more Fortune 500 companies to an already impressive client roster.”

Datamaran’s previous funding round was led by Fortive with participation from American Electric Power. The company’s clients benefit from its platform as a governance tool, enabling accountability and flexibility in a rapidly evolving ESG landscape, driven by regulations like the EU’s Corporate Sustainability Reporting Directive.