Ceres, a US-based nonprofit advocacy organisation, has issued new recommendations for the US banking sector, urging improvements in climate finance target-setting and disclosures. The report highlights that policies like the US Inflation Reduction Act have sparked trillions of dollars in green financing opportunities, but there remains no consistent methodology for investors or regulators to compare US banks’ performance in this area.

In its latest report, “Ahead or Behind? The State of Climate Finance in the Banking Sector,” Ceres outlines key recommendations to help banks design effective climate finance targets, improve disclosure practices, and adopt best practices from peers.

Core suggestions include setting robust climate finance targets and offering climate-linked products and services, focusing on the additional impact that banks’ actions can generate , using consistent accounting methodologies across metrics and targets, and establishing clear eligibility criteria for sustainable finance activities.

The report also calls for enhancing the consistency and utility of information provided in disclosures, aligning with international disclosure standards and frameworks, and collaborating with other banks to create voluntary disclosure standards.

“US banks have committed trillions of dollars to climate finance, but investors and consumers cannot compare banks on these commitments. Our report provides a critical roadmap for banks to demonstrate real impact and additionality in their climate finance efforts so they can measure and show their progress in meaningful ways,” said Holly Li, co-author of the report and Net Zero Program Director, Ceres Accelerator for Sustainable Capital Markets.

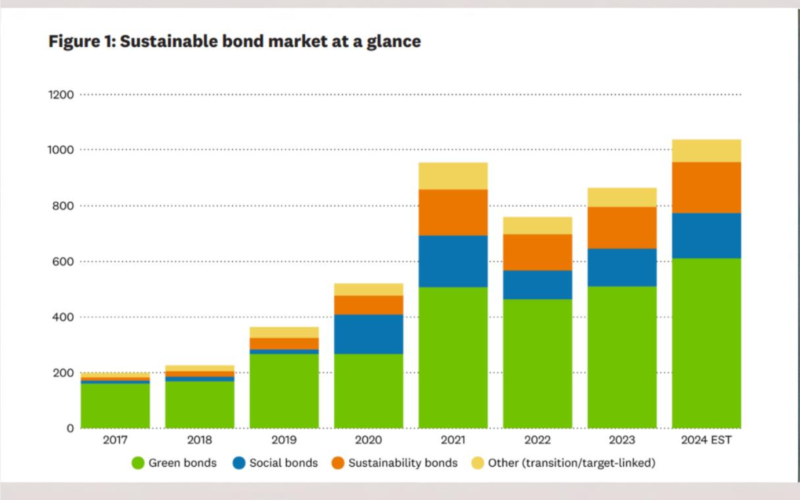

The report also emphasises the significant opportunities presented by the global shift toward a low-carbon economy, which has unlocked trillions of dollars in investments. In 2023, green financing generated approximately $3 billion in fees, surpassing revenues from issuing fossil fuel debt for the second consecutive year. Since the passage of the Inflation Reduction Act, about $270 billion in new capital investments have been announced in US solar, wind, and battery storage projects.

“The transition to a low-carbon economy represents risks and massive opportunities for U.S. banks. The banks that can differentiate themselves through credible, ambitious climate finance strategies will be best positioned to thrive in the clean energy economy in the coming decade,” said Blair Bateson, co-author and Director of the Company Network, Financial Services at Ceres.

Ceres’ guidance aligns with the goals of Ambition 2030, an initiative aimed at decarbonising the six highest-emitting sectors of the economy, including banking.