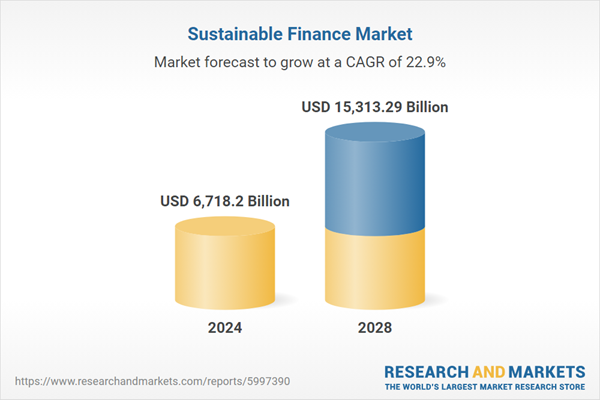

The sustainable finance market has seen substantial growth and is projected to continue its upward momentum, with forecasts predicting an increase from $5.48 trillion last year to $6.71 trillion by the end of 2024, reflecting a strong compound annual growth rate (CAGR) of 22.4%.

According to the “Sustainable Finance Market Report 2024” report by Research and Markets, key drivers behind this expansion include rising investor demand, heightened focus on risk management, corporate social responsibility, regulatory support, and increased investments in renewable energy.

The sustainable finance market generates revenue through innovative and ethical financial services such as sustainable loans, ESG integration, and advisory services for various financial instruments. This growth highlights a broader commitment across industries to build a sustainable economy that benefits society as a whole.

Looking ahead, the market is expected to grow exponentially, reaching $15.31 trillion by 2028, with a projected CAGR of 22.9%. Growth will be driven by initiatives to reduce the global carbon footprint, increasing demand for sustainable investment options, and greater awareness of sustainability across sectors. The expansion of green bonds and sustainable financial products will also play a significant role. Technological advancements, green technology integration, and financing for climate resilience are expected to be key trends during this period.

The corporate sector’s focus on social responsibility is set to be a major contributor to the growth of the sustainable finance market. Companies are increasingly prioritising societal and environmental impact as part of their operations, motivated by both ethical imperatives and reputational gains. This emphasis on Corporate Social Responsibility (CSR) is enhancing stakeholder engagement and creating new opportunities for innovative financial products. CSR initiatives align financial practices with ethical, environmental, and social objectives, ultimately supporting a more sustainable global economy.

Corporations in the sustainable finance space remain at the forefront of innovation, developing financial products and strategies that adhere to environmental, social, and governance (ESG) standards. One significant development is the launch of a Sustainable Finance Innovation Hub by a leading UK-based transaction services firm, aimed at helping global financial institutions navigate ESG regulations and reporting requirements.

To strengthen their capabilities, major consultancies in the UK have made strategic acquisitions, such as the recent purchase of a US-based ESG consultancy by a UK firm, expanding their influence in the Latin American market. These business moves demonstrate the sector’s dedication to increasing expertise and expanding its global impact.

North America led the sustainable finance market in 2023, while the Asia-Pacific region is expected to be the fastest-growing area during the forecast period. The integration of ESG criteria into financial decision-making, including investment strategies and lending practices, continues to promote economic growth while mitigating environmental impact and fostering good governance.

As the sustainable finance market evolves, it spans a diverse range of investors, sectors, and financial instruments that collectively drive progress toward global economic sustainability. The ongoing commitment of leading financial institutions to sustainable finance signifies a dynamic and growing industry that balances profitability with broader social and environmental goals.