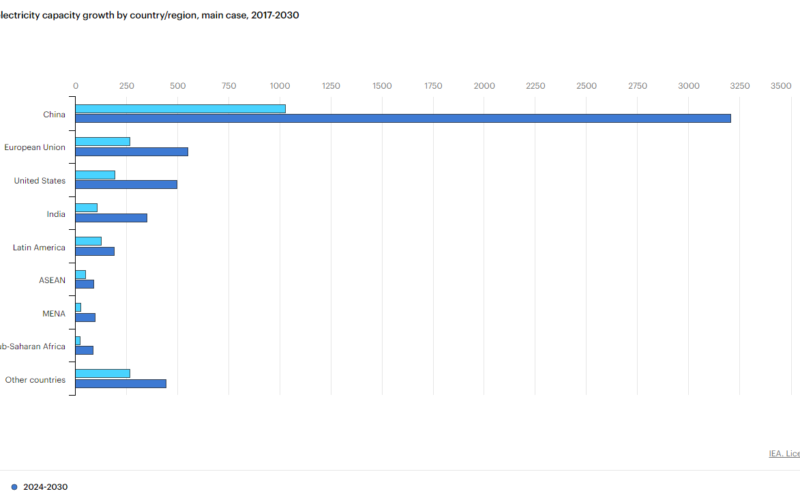

Renewables, led by solar, are on track to meet nearly half of global electricity demand by 2030, according to a new International Energy Agency (IEA) report. Supported by favorable policies and economic conditions, the world’s renewable power capacity is expected to surge, with global additions expected to match the current power capacity of China, the EU, India, and the US combined. The Renewables 2024 report projects over 5,500 gigawatts (GW) of new capacity between 2024 and 2030, nearly tripling the increase seen between 2017 and 2023.

China is anticipated to account for nearly 60% of all new renewable capacity installed by 2030, positioning it to host almost half of the world’s total renewable power capacity by decade’s end. While China is leading in volume, India is growing at the fastest rate among major economies. Solar PV is forecast to drive 80% of this growth, with large solar plants and rooftop installations contributing to this surge. Wind power is also expected to see a recovery, with its rate of expansion set to double compared to the previous period.

As a result, nearly 70 countries, accounting for 80% of global renewable power capacity, are on track to meet or exceed their 2030 renewable energy targets. While the world is on pace to increase its renewable capacity to 2.7 times its 2022 level, further government action will be necessary to meet the COP28 goal of tripling capacity by 2030. The report urges governments to adopt bolder plans and improve international cooperation, particularly to address high financing costs in emerging markets, which could hinder growth in regions like Africa and Southeast Asia.

“Renewables are moving faster than national governments can set targets for. This is mainly driven not just by efforts to lower emissions or boost energy security – it’s increasingly because renewables today offer the cheapest option to add new power plants in almost all countries around the world,” said IEA Executive Director Fatih Birol.

Birol added, “This report shows that the growth of renewables, especially solar, will transform electricity systems across the globe this decade. Between now and 2030, the world is on course to add more than 5 500 gigawatts of renewable power capacity – roughly equal the current power capacity of China, the European Union, India and the United States combined. By 2030, we expect renewables to be meeting half of global electricity demand.”

The report also highlights the importance of integrating solar and wind into electricity grids, calling for policies to address power system flexibility and permitting bottlenecks. It emphasises that improving grid infrastructure and building 1,500 GW of storage capacity will be key to accommodating more renewable generation. The share of renewables in total energy consumption is projected to rise to 20% by 2030, up from 13% in 2023.

While renewable electricity is growing rapidly, renewable fuels, such as biofuels and hydrogen, are lagging. The IEA stresses the need for stronger policy support to decarbonise sectors that are difficult to electrify. Without significant intervention, the share of renewable fuels in global energy is expected to remain below 6% by 2030.

Solar manufacturing is another focus, with global capacity expected to exceed 1,100 GW by the end of 2024, double the projected demand. This surplus, primarily concentrated in China, has driven down module prices but resulted in financial losses for many manufacturers. Diversification efforts are underway, with solar manufacturing expected to triple in the US and India by 2030, though production costs remain significantly higher than in China. The IEA calls on policymakers to weigh the costs and benefits of local manufacturing, balancing priorities such as job creation and energy security.