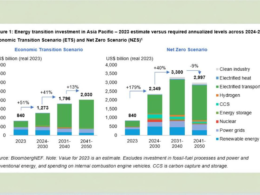

In 2024, global insurers are intensifying their focus on clean energy infrastructure and private market investments, according to BlackRock’s 13th annual Global Insurance Report. With nearly 99% of insurers surveyed committing to low-carbon transition goals, clean energy has become a central theme in their portfolios. The report highlights that 60% of insurers plan to allocate more to wind, solar, and energy storage technologies to manage and mitigate climate risks.

Olivier Van Eyseren, Head of BlackRock’s Financial Institutions Group for EMEA said, “Insurers are recognising the long-term value of clean energy investments in meeting their sustainability goals while navigating regulatory and capital requirements.”

BlackRock’s Global Insurance Survey, conducted between July and September 2024, gathered insights from 410 senior insurance executives across 32 markets. Together, these companies manage approximately $27 trillion USD in assets. The survey highlights how insurers are navigating market risks, geopolitical tensions, and regulatory developments while seizing opportunities in clean energy and private markets.

For the third consecutive year, BlackRock’s survey revealed that a majority of insurers plan to increase their investments in private markets, with 91% intending to do so within the next two years. This figure rises to 96% for insurers in the Asia-Pacific and North American regions. Clean energy infrastructure, including renewable energy sources like wind and solar, is at the forefront of these investments as insurers prioritise environmental sustainability.

Mark Erickson, Global Head of BlackRock’s Financial Institutions Group said, “We’ve seen rapidly accelerated demand for private markets among insurers in recent years, given these investments’ dual benefits of diversification and increased income generation.”

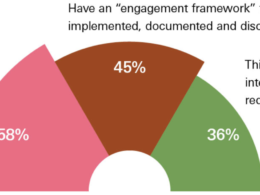

Insurers’ conviction in supporting the low-carbon transition has strengthened, with 66% expressing more confidence in these investments compared to last year. Stakeholder demand, regulatory pressure, and climate risk mitigation are the driving forces behind this shift.

Additionally, insurers are leveraging technology to streamline their asset allocation strategies, particularly in managing clean energy portfolios. Integrated asset allocation and private asset modeling have emerged as key areas for technological innovation, enabling insurers to better align their investments with the global push toward sustainable energy.

With 2024 expected to be a landmark election year, insurers are increasingly concerned about political uncertainty affecting macro risks. They specifically highlight regulatory changes (68%) and rising geopolitical tensions and fragmentation (61%) as their primary concerns. Interest rate risk (69%) and liquidity risk (52%) are also cited as significant market challenges. Despite these concerns, 74% of insurers have no plans to alter their current risk profiles. Many insurers emphasise the value of partnerships to enhance their internal capabilities in risk assessment and portfolio management. In fact, 40% of respondents believe that partnering with an investment firm that understands their business and operating model is crucial to achieving strategic goals.

In public markets, 42% of insurers plan to increase investments in government and agency bonds, while 33% aim to boost exposure to inflation-linked bonds, as 46% identify inflation as a key macro risk. Additionally, 44% are looking to allocate more funds to cash and short-term instruments to enhance liquidity.

In private markets, insurers are diversifying into private debt across several categories, including opportunistic private debt (41%), private placements (40%), direct lending (39%), and infrastructure debt (34%). As the scope of private debt continues to broaden, BlackRock’s report indicates that this asset class can help insurers align long-term investments with long-term liabilities, and capitalise on illiquidity premiums. Moreover, 52% of insurers plan to increase their exposure to multi-alternative investments, allowing for greater flexibility and tailored strategies.

In response to an increasingly volatile macroeconomic and regulatory landscape, insurers are also prioritising technology investments. Integrated asset allocation (63%) and asset-liability management (61%) are key focus areas for tech platforms, while 51% see value in leveraging technology for regulatory capital integration. As insurers expand their presence in private markets, 53% believe that private asset modeling is another area where technology can provide a competitive edge.