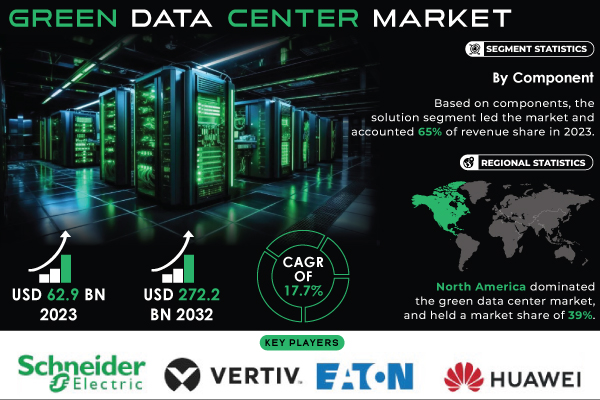

The global green data centre market, currently valued at $62.9 billion in 2023, is projected to expand to $272.2 billion by 2032, growing at a robust compound annual growth rate (CAGR) of 17.7% from 2024 to 2032. This growth is fuelled by rising regulatory pressures, corporate sustainability initiatives, and innovations aimed at reducing carbon emissions, according to SNS Insider.

Central to the rise of green data centres is the global push for sustainability and energy efficiency, with governments implementing stricter regulations and offering incentives to encourage eco-friendly data infrastructure. The European Union’s Green Deal mandates significant carbon emission reductions, while the U.S. has introduced tax incentives for sustainable technologies. This has led organisations to increase investment in renewable energy sources, such as solar and wind, along with advanced cooling technologies, to support sustainability goals and reduce operational costs. According to the International Energy Agency (IEA), data centre energy demand is expected to grow by 4% annually through 2030, highlighting the need for renewable energy integration.

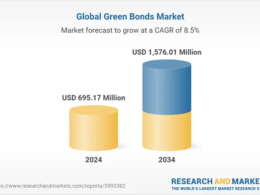

Despite doubling private sector investment to $8 billion in 2021/2022, public finance still dominates, accounting for 82% of the total funding in the green data centre sector. Regional imbalances persist, with the top ten African countries receiving half of the continent’s total climate finance, while 30 countries receive only 10%. South Africa, Egypt, and Nigeria account for 50% of private financing, indicating the need for a more balanced investment across regions.

The BFSI sector accounted for 23% of the market’s revenue in 2023, driven by increased reliance on data-intensive applications like real-time transactions and digital banking. The demand for energy-efficient infrastructure is further accelerated by regulatory standards from bodies like the FCA and SEC, which mandate stringent data processing requirements. Meanwhile, emerging technologies like AI-powered energy management systems and cloud computing are driving demand for green data centres, allowing for real-time energy monitoring and optimised power consumption. Liquid cooling and immersion cooling technologies are also gaining popularity for their potential to enhance energy efficiency.

North America led the global green data centre market in 2023, supported by major tech giants like Google, Microsoft, and Amazon, all committed to net-zero carbons emissions. The U.S. Department of Energy’s Data Centre Optimisation Initiative promotes energy efficiency across federal data centres. In the Asia-Pacific region, rapid digital transformation, cloud adoption, and government policies supporting sustainable infrastructure have fuelled market growth, with countries like China, India, and Japan investing significantly in green technologies.

Recent developments include Google’s expansion of green data centres in Europe with AI-driven energy management systems in June 2024, Microsoft’s initiative for zero-waste data centres by 2030 launched in March 2024, and Equinix’s $3 billion investment in new green data centres across North America announced in February 2024. The market’s growth is driven by technological advancements, sector-specific needs, and regulatory support, positioning green data centres as crucial to sustainable IT infrastructure across industries.