BeZero Carbon has introduced an innovative approach to rating carbon credit portfolios, designed to provide buyers with a more accurate, risk-adjusted way to make carbon-based claims. This marks the first time portfolio theory has been applied to carbon credits, supporting higher integrity and stricter risk management standards in the carbon market.

The BeZero Carbon Portfolio Rating allows carbon credits to be bundled into portfolios, offering buyers a more reliable way to claim emissions reductions. Developed from insights in BeZero’s whitepaper, Making Credible Claims, this new system enables carbon credits to be represented as risk-adjusted tonnes, aligning with varying levels of confidence in achieving a tonne of CO₂e.

Carbon credits have traditionally been labelled as achieving exactly one tonne of CO₂e, but each credit carries risks, making such precise claims misleading. BeZero’s rating system, which is publicly available and updated in real-time, reflects the likelihood of each credit reaching its CO₂e reduction target. This enables buyers to make more credible claims, accounting for risk and providing transparency across the carbon market.

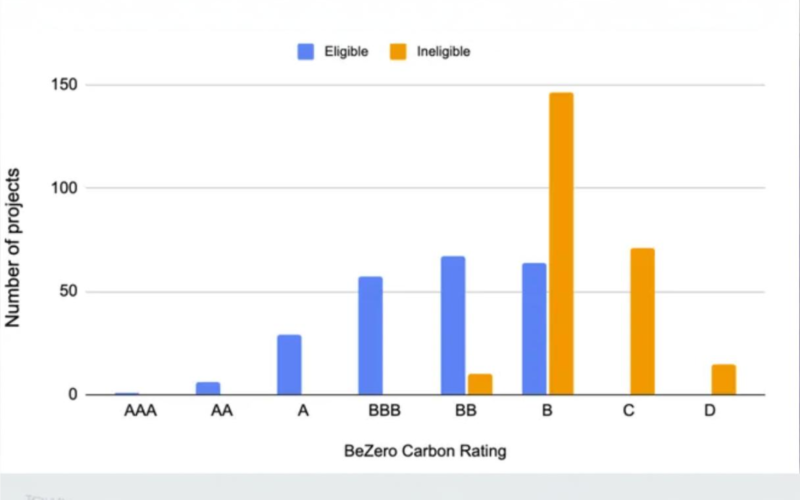

BeZero Carbon’s methodology incorporates strict risk management guardrails to uphold integrity in the carbon market. For a portfolio to be eligible, it must meet several criteria: only carbon credits rated ‘B’ or higher by BeZero qualify, while those rated C, D, withdrawn, or under ratings watch are excluded. Additionally, credits with significant additionality risks cannot be part of the portfolio. The overall rating of a portfolio cannot surpass the highest-rated credit within it, which must constitute at least 25% of the portfolio’s composition. Moreover, individual project ratings can only be enhanced by a maximum of two notches through discounting. This rigorous approach ensures that only high-integrity credits are included, promoting greater transparency and credibility in carbon offsetting.

These criteria exclude over half of the currently rated carbon credits, ensuring that only credits with higher integrity are included. This approach strengthens the credibility of portfolios and provides a more transparent tool for carbon offset claims. BeZero Carbon’s new methodology is seen as a critical innovation for scaling the carbon credit market. It encourages diversification, aligns with best practices from financial markets, and supports broader buyer participation. By empowering intermediaries to better understand and manage risks, the approach aims to create a more sustainable carbon market.

The company will host a webinar featuring experts from across the market to discuss the opportunities and challenges of using portfolio ratings. This launch signals BeZero’s commitment to driving market innovation and higher standards of credibility in carbon offset claims.