The rapid adoption of clean energy technologies worldwide offers substantial opportunities for nations looking to manufacture and trade these solutions but also presents complex policy challenges, as highlighted in a new report by the International Energy Agency (IEA).

The ‘Energy Technology Perspectives 2024’ (ETP-2024), the IEA’s latest technology publication, provides insights into the trajectory of six key clean energy technologies—solar PV, wind turbines, electric vehicles, batteries, electrolysers, and heat pumps. Based on current policy trends, the global market for these technologies is expected to soar from $700 billion in 2023 to over $2 trillion by 2035, nearing the value of the global crude oil market. Trade in clean technologies is anticipated to increase significantly, with projections showing it will triple within a decade, reaching $575 billion—a figure more than 50% higher than today’s global natural gas trade.

ETP-2024 also examines critical materials like steel and aluminium, offering a unique analytical framework for policymakers navigating the evolving landscape of clean energy manufacturing and trade. Built on extensive data and modelling based on national policies, the report charts current trends in clean energy production and trade, identifying how nations at different development stages can capitalise on the emerging energy economy while ensuring secure and cost-efficient clean energy transitions.

“The market for clean technologies is set to multiply in value in the coming decade, increasingly catching up with the markets for fossil fuels. As countries seek to define their role in the new energy economy, three vital policy areas – energy, industry and trade – are becoming more and more interlinked. While this leaves governments with tough and complicated decisions ahead, this groundbreaking new IEA report provides a strong, data-driven foundation for their decisions,” said IEA Executive Director Fatih Birol.

He added, “Clean energy transitions present a major economic opportunity, as we have shown, and countries are rightly seeking to capitalise on that. However, governments should strive to develop measures that also foster continued competition, innovation and cost reductions, as well as progress towards their energy and climate goals.”

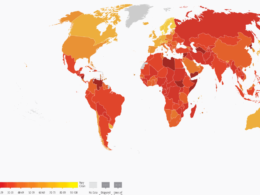

The growth in clean technology markets has spurred record investments in clean manufacturing as nations aim to enhance energy security, economic competitiveness, and emission reductions. Much of this investment is concentrated in countries already established in the sector, including China, the EU, the US, and India. Although the US has implemented supportive legislation like the Inflation Reduction Act and Bipartisan Infrastructure Law, and the EU and India have introduced similar measures, China is expected to maintain its dominance in manufacturing. Under current policies, Chinese exports of clean technology are projected to exceed $340 billion by 2035, a figure comparable to the combined oil export revenues of Saudi Arabia and the UAE in 2023.

Currently, nations in Southeast Asia, Latin America, and Africa account for less than 5% of the total value from clean technology production. However, ETP-2024 stresses that the new clean energy economy presents opportunities for nations at various development stages. The report highlights specific avenues for emerging and developing economies to leverage their competitive advantages in clean energy, drawing from an assessment of over 60 indicators, including business environment, energy and transport infrastructure, resource availability, and domestic market size.

Emerging economies, beyond mineral mining and processing, could capitalise on their strengths to advance in the clean energy value chain. For instance, Southeast Asia is well-positioned to become a low-cost producer of polysilicon and wafers for solar panels within the next decade, while Latin America, especially Brazil, could enhance its wind turbine production for export across the Americas. North Africa could evolve into a hub for EV manufacturing within a decade, and various countries in sub-Saharan Africa have potential for producing low-emissions hydrogen-based iron.

“Growth in the manufacturing and trade of clean energy technologies should be for the benefit of many economies, not just a few,” Dr Birol said. “This report shows that countries in Southeast Asia, Latin America, Africa and beyond and have strong potential to play important roles in the new energy economy. And it finds that with sound strategic partnerships, increased investment and greater efforts to bring down high financing costs, they can achieve this potential.”

The report also explores global implications as clean energy technology trade expands. A shift from fossil fuel imports to clean technology imports could bolster the resilience of energy supplies. Unlike fossil fuels, which require constant replenishment, imported clean technologies offer durable energy equipment. This shift enhances efficiency: a single shipment of solar PV modules can generate as much electricity as over 50 LNG tankers’ worth of natural gas or more than 100 bulk shipments of coal.