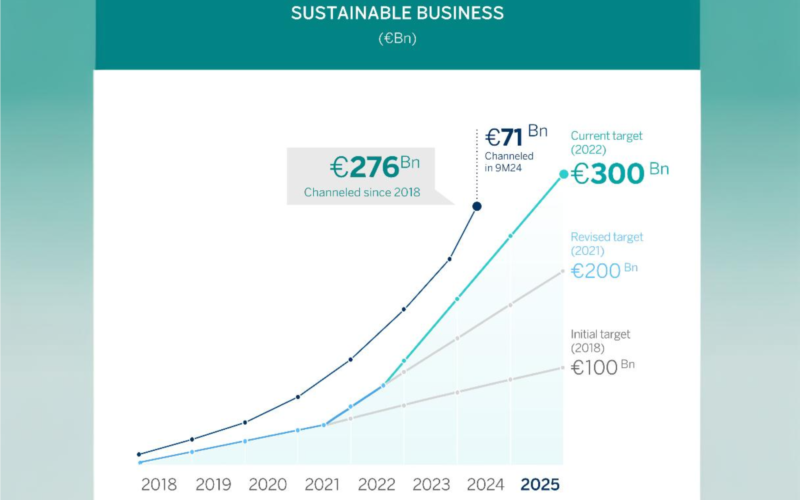

Spanish financial giant BBVA has mobilised €276 billion ($300 billion) for climate action and inclusive growth initiatives from 2018 through September 2024, surpassing initial projections to achieve its €300 billion ($327 billion) target by 2025.

“We’re very close, and at this pace, we’ll reach our goal ahead of schedule,” stated Javier Rodríguez Soler, Global Head of Sustainability and Corporate & Investment Banking (CIB) at BBVA.

Of the funds mobilised, 77% has gone toward climate change mitigation and natural capital conservation, while 23% supports inclusive growth. BBVA’s CIB division alone contributed approximately €37 billion ($40 billion) between January and September, marking a 38% increase over the same period last year, with €13 billion ($14.1 billion) allocated in the most recent quarter.

In its wholesale sector, BBVA has intensified financing for clean technologies, renewable energy, and sustainability-linked services. Notably, in Q3 2024, the bank dedicated around €690 million ($752 million) to renewable energy projects, more than doubling last year’s figure, with the US accounting for over half of this sum.

BBVA’s corporate banking unit recorded approximately €24 billion ($26 billion) in sustainable financing from January to September, reflecting a 55% increase year-over-year. In Q3 2024 alone, it directed nearly €9 billion toward sustainable initiatives. The unit continues to advise businesses on sustainable solutions, including energy efficiency, fleet renewal, and water footprint reduction. Financing for natural capital projects, such as agribusiness and circular economy efforts, reached nearly €600 million in Q3, up 59% from last year.

BBVA’s retail division mobilised €9 billion ($9.8 billion) in sustainable financing in the first nine months of 2024, a 41% increase year-over-year, with around €4 billion ($4.4 billion) allocated in Q3 alone. This growth was fueled by tailored digital solutions promoting energy-saving measures in homes and transportation. Noteworthy is the surge in financing for hybrid and electric vehicles, which totalled €192 million in Q3, marking a 106% increase over the previous year.

In a strategic move, BBVA launched a sustainability hub in Houston this quarter, aiming to lead US energy transition financing. This hub will support sustainable growth and decarbonization initiatives, targeting renewable and clean technologies, such as energy storage, hydrogen, carbon capture, and electric vehicles. The new Houston office complements BBVA’s existing teams in New York, London, and Madrid, which are focused on financing innovations in clean technology.