Carbon Direct released its ‘2024 State of the Voluntary Carbon Market’ report, spotlighting significant trends and issues shaping the voluntary carbon market, with a strong focus on carbon dioxide removal (CDR). According to the report, while CDR is expanding quickly, it still comprises only 4% of available carbon credits in the current US$1 billion market. Carbon Direct’s analysis indicates that although there is an oversupply of carbon credits in the broader market, demand for high-quality CDR credits outstrips their availability. Notably, most forward CDR offtakes in 2024 have been concentrated among a select few first movers.

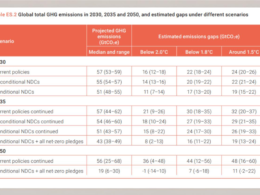

In light of global climate goals, the need for CDR is pressing. International targets call for removing 5-10 billion tonnes of CO₂ annually by 2050, which will require trillions of dollars in investment. However, concentrated demand, the need for rapid scale, and a lack of high-quality projects present considerable barriers to reaching these goals. Carbon Direct projects demand for approximately 50 million tonnes of CDR per year by 2030, but current project financing covers less than half of this volume. This 50 million tonnes represents less than 5% of the new CDR needed to align with some 1.5°C climate pathways.

“The CDR market is at a crucial inflection point. While we’re seeing ambitious scale-up plans from high-durability CDR projects and increased funding for nature-based solutions, the market urgently needs more buyers and investors to step forward to realise this potential,” said Matthew Potts, Chief Science Officer at Carbon Direct.

The report’s analysis, which draws from major carbon credit registries and Carbon Direct’s project evaluations, highlights several key findings. One such finding is that projects focusing on nature-based CDR are well-positioned to provide a majority of near-term credits at accessible prices, but they face significant funding shortfalls in relation to both climate needs and potential demand. Also, while high-durability CDR projects have ambitious plans to scale, they require substantial forward offtake commitments to secure the financing necessary for project expansion.

The report also finds that forward offtake agreements for CDR credits remain highly concentrated among a small group of high-profile buyers, especially for high-durability CDR solutions. Additionally, the voluntary carbon market as a whole remains relatively small, growing only around 3% over the past year—a stark contrast to the 10x growth needed by 2030.

“To meet global climate goals, we need to see a significant acceleration in both investment in nature-based CDR and forward purchasing of high-durability CDR solutions,” Potts continued, “The VCM serves as a critical vehicle for channeling finance to CDR projects.”

The report concludes by underscoring that achieving climate targets will require developing mature market structures to support project development and finance, backed by bankable offtake agreements. Projects will also need to demonstrate high levels of quality and transparency to address buyer concerns and mitigate reputational risks.