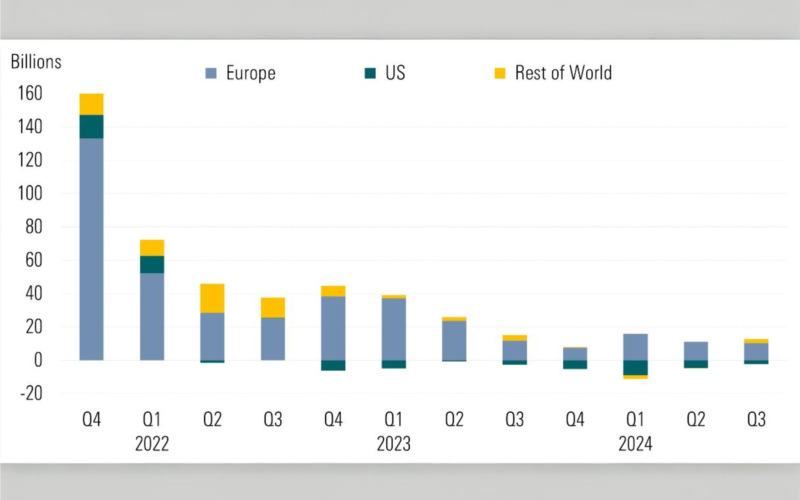

Environmental, social, and governance (ESG) open-end and exchange-traded funds globally attracted an estimated $10.4 billion in net new investments in Q3 2024, marking a significant increase from $6.3 billion in Q2 and $4.8 billion in Q1. According to the ‘Global ESG fund flows: Q3 2024’ report by Morningstar, Europe’s sustainable bond funds outperformed their conventional counterparts, driving the organic growth rate of global ESG fund coverage to 0.33%, up from a restated 0.20% three months earlier. However, this growth rate remains below the broader fund market, which saw 0.77% growth and an influx of $373 billion, bolstered by economic optimism and market gains. The organic growth metric, representing net flows relative to initial period assets, offers insight into the flow intensity.

The increase in global ESG fund inflows was mainly due to reduced outflows in the US, Japan, and Canada, though Europe saw slightly lower subscriptions compared to Q2. Global ESG fund assets rose to $3.3 trillion, from $3.1 trillion, aligning with positive market trends as the Morningstar Global Market Index and the Morningstar Global Core Bond Index grew 6.6% and 6.9%, respectively.

European ESG funds drew nearly $10.3 billion in Q3, down from a revised $11.1 billion in Q2. Europe remains the largest ESG fund market globally, holding 84% of assets. This decline in flow contrasts with the growth of conventional funds in Europe, which grew 0.67% organically, bringing in over $122 billion. Through the first nine months of 2024, European ESG funds attracted just $37 billion, about half the inflows recorded over the same period in 2023.

Within the EU’s Sustainable Finance Disclosure Regulation (SFDR) framework, Article 8 funds (promoting environmental or social characteristics) gathered €38 billion in new investments—their highest inflow since late 2022. Article 8 funds now represent about 56% of the EU’s total fund assets. Under SFDR, funds are classified as Article 6, 8, or 9, with Article 8 funds focused on ESG characteristics and Article 9 funds committed to sustainable investment objectives.

Redemptions from Article 9 funds continued for the fourth consecutive quarter, with investors pulling €2.2 billion. In contrast, Article 8 funds achieved a 0.7% organic growth rate, though still below the 2.4% growth rate for Article 6 funds. Article 8 bond funds saw inflows nearing €45 billion in Q3, surpassing the €39 billion gathered by Article 6 bond funds. Fixed-income products have been the sole asset class with steady flow recovery in 2024 as investors seek appealing yields to hedge against price volatility. With bond market prices now factoring in anticipated rate cuts and reduced inflation risks, bonds have become a potentially attractive investment.

Conversely, inflows into Article 8 and Article 9 equity funds remained weak. Article 8 equity funds saw net inflows of €2 billion, but redemptions from Article 9 equity funds continued, totaling nearly €2.7 billion in outflows for the quarter. Combined assets in Article 8 and Article 9 funds stayed around €6 trillion at the end of September, holding 61% of the EU market share.

New ESG fund launches in Europe hit a low, with only 43 new funds in Q3, compared to 70 in Q2 and 76 in the same quarter last year. This slowdown in product launches reflects a broader hesitancy across the Article 6, 8, and 9 categories, partly driven by economic uncertainty, high inflation, and elevated interest rates. Newly launched Article 8 and Article 9 funds accounted for 56% of all EU fund launches in Q3, a slight increase over Q1 2024.

Rebranding has also shaped the Article 8 and Article 9 fund landscape. Funds previously adding ESG-related terms in 2022 have now begun to remove them, a trend gaining traction since Q4 2023. By September, 91 Article 8 funds had changed names—39 added ESG-related terms, 40 dropped them, and 12 swapped terms. Prominent Article 8 funds removing ESG terms in Q3 included Fidelity Funds Emerging Markets Ex China Fund, Ninety One Global Macro Allocation, and Neuberger Berman Global Value Fund. Article 9 funds have also seen rebranding activity, with eight funds replacing an ESG-related term, continuing a trend that saw 14 such changes throughout 2023.