A first-of-its-kind report by the International Energy Agency (IEA) highlights the immense potential of scaling up critical minerals recycling to bolster energy security, diversify supply chains, and reduce greenhouse gas emissions. As countries accelerate their clean energy transitions, new policies and facilities supporting the recycling of critical minerals—key components in technologies like solar panels, wind turbines, electric vehicles, and batteries—could alleviate supply pressures and reduce reliance on new mining.

The IEA’s report, Recycling of Critical Minerals: Strategies to Scale Up Recycling and Urban Mining, reveals that increased recycling could lower the need for new mining of critical minerals like copper, cobalt, lithium, and nickel by 25–40% by 2050. Under scenarios where countries meet their announced climate pledges, recycling could cut the demand for new mines by 40% for copper and cobalt and by 25% for lithium and nickel.

While investments in new mines remain essential due to growing demand and natural declines in existing mines, enhanced recycling efforts could reduce the required $600 billion mining investment through 2040 by 30%.

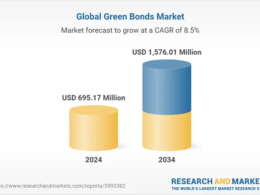

Despite rising material consumption, the use of recycled critical minerals has not kept pace, with shares of secondary copper and nickel in decline. However, the IEA report points to significant opportunities for expansion. As electric vehicles (EVs) and clean energy technologies reach the end of their lifecycle, the availability of recyclable feedstock is set to surge after 2030. The market for recycled battery metals has already seen an 11-fold increase in less than a decade.

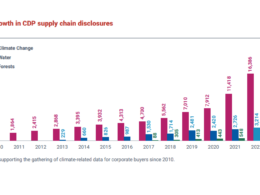

Policy interest in recycling is growing, with more than 30 measures introduced globally in the last three years. If these policies are implemented fully, the market value of critical minerals recycling could reach $200 billion by 2050.

Recycling critical minerals offers far-reaching benefits for energy security by reducing dependence on imports and mitigating risks of supply shocks and price volatility. This is especially crucial for regions with limited mineral resources but significant clean energy deployment. Recycling also cuts greenhouse gas emissions by 80% compared to primary mining, reduces environmental and social impacts, and prevents valuable materials from ending up in landfills.

“Recycling is vital to tackling the challenges around critical mineral supplies and ensuring long term sustainability,” said IEA Executive Director Fatih Birol, adding, “Investment in new mines and refineries remains crucial but there is ample opportunity for recycling to maximise the resources already at our disposal. As we move into the Age of Electricity, we have to take advantage of this treasure trove of worn batteries and electrical devices that could be revived and reused, but to do so we must develop a mature marketplace for recycling to make it attractive and easily accessible.”

China leads in battery recycling, commanding over 70% of the market for pretreatment and material recovery. The country has recently launched a state-owned enterprise to boost recycling and reuse efforts. However, recycling capacity in Europe, the US, and India significantly lags, with projected feedstock coverage by 2040 at 30% in Europe and the US and just 10% in India.

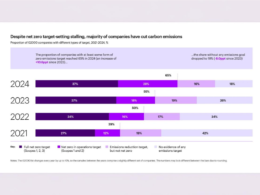

Policy frameworks supporting recycling include financial incentives and material recovery targets, but the report stresses the need for more comprehensive strategies and regulatory clarity. Export rules for used batteries and EVs remain significant barriers to investment in recycling infrastructure.

While critical minerals recycling is pivotal to clean energy sustainability, the report warns of potential environmental and social risks from poorly managed processes, such as pollution and water contamination. It highlights the need for robust recycling standards and clear, long-term policy roadmaps with specific targets and milestones to encourage investment.

With battery recycling capacity growing at 50% year-on-year in 2023, the IEA’s report offers a blueprint for policymakers to harness the full potential of critical mineral recycling, ensuring a sustainable and secure energy future.