Assets in sustainable funds are poised for significant growth in the next two years, according to the latest ‘Sustainable Signals’ report by the Morgan Stanley Institute for Sustainable Investing. Based on a survey of over 900 institutional investors across North America, Europe, and Asia Pacific conducted in mid-2024, the report highlights shifting attitudes and emerging trends in sustainable investing.

Key findings reveal that 78% of asset managers and 80% of asset owners anticipate higher allocations to sustainable funds, fueled by new mandates and increased interest from existing clients. Over three-quarters of asset owners noted that sustainable investing offerings play a crucial role in mandate decisions, with 80% requiring asset managers to implement sustainability-focused strategies.

“Institutional investors see a growth trajectory for sustainable assets globally in the coming years to meet increasing client and stakeholder demands in a more mature sustainable investing market,” said Jessica Alsford, Chief Sustainability Officer and Chair of the Institute for Sustainable Investing at Morgan Stanley.

She added, “This year the Institute has released Sustainable Signals reports with views from individual investors, corporates and institutional investors, with each group seeing sustainability as an opportunity for growth and value creation.”

As per the report, data availability (71%), inconsistent regulatory guidance (69%), and greenwashing concerns (68%) are the top challenges cited by institutional investors. Also, APAC respondents reported greater difficulties, especially with disclosure burdens (71%), compared to their counterparts in Europe and North America.

The report highlights that globally, healthcare (41%) and financial inclusion (40%) lead as the top sustainable investment themes. Additionally, European investors prioritise nature and biodiversity solutions more than others, while climate adaptation solutions are viewed as underappreciated globally.

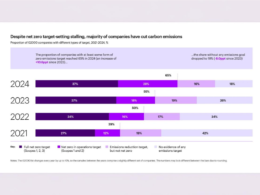

Also, nearly two-thirds of respondents have set net-zero targets, with most having actionable plans, according to the survey. Carbon offsets remain a contentious issue, with 40% of asset owners using them for portfolio emissions. However, opinions are divided: while some view offsets as valid tools for decarbonisation, others believe they should be reserved for hard-to-abate emissions or are waiting for clearer guidance.

The report highlights a growing consensus among institutional investors about the opportunities presented by sustainable investing. It also highlights areas of concern, particularly around regulatory consistency and data quality, as the sector matures.