A recent study highlights the growing significance of environmental, social, and governance (ESG) factors in global trade, as businesses increasingly prioritise ESG criteria in supplier selection to mitigate risks and enhance resilience. This shift highlights a broader recognition of the interconnected challenges impacting supply chains, which remain the cornerstone of international trade and a strategic priority for businesses worldwide.

The 2024 Global Trade Report by the Thomson Reuters Institute identifies supply chain due diligence as the most impactful systemic change and highlights supply chain issues as the top strategic priority for the year. Professionals in global trade cite diverse and unpredictable disruptions, including natural disasters, geopolitical conflicts, infrastructure challenges, and labour shortages, as major concerns.

“Natural disasters and infrastructure issues frequently disrupt our supply chain, making resilience a top priority,” noted one respondent. Geopolitical tensions and climate change further exacerbate risks, compelling companies to diversify suppliers geographically and numerically to reduce exposure to localised disruptions and enhance adaptability.

ESG considerations are becoming pivotal in supplier evaluations, with 81% of global trade professionals deeming them important or very important. The emphasis on ESG is particularly pronounced in regions such as the United States (97%), the United Kingdom, and the European Union (90%). Conversely, the importance is somewhat lower in Latin America (70%) and the Asia-Pacific (58%).

This prioritisation reflects growing recognition of the link between ESG practices and risk mitigation. For instance, climate change—driven by rising carbon levels—has increased the frequency of natural disasters, while labour rights and human rights issues have intensified focus on ethical sourcing and workplace standards.

“Meeting consumer demands for sustainability is crucial,” explained another respondent. “We are focusing on ethical sourcing and reducing our carbon footprint.”

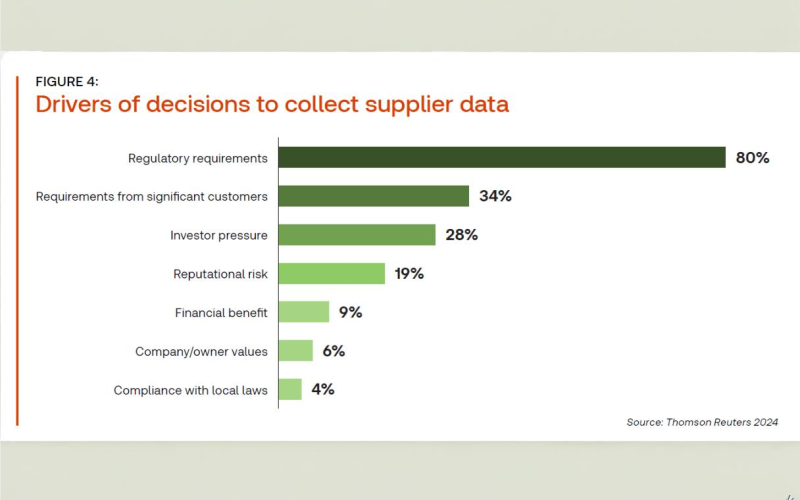

Regulatory requirements are the primary driver for collecting supplier ESG data, with 80% of respondents identifying them as critical. Additional motivators include demands from significant customers (34%), investor pressure (28%), and reputational risk (19%).

Upcoming regulations, such as the EU Corporate Sustainability Due Diligence Act, are accelerating this trend. The Corporate Sustainability Reporting Directive, adopted in 2023, now mandates companies meeting specific criteria to report on environmental and social risks and their impact on people and the planet. Major trading nations are also increasingly imposing laws requiring ESG reporting and restricting trade in goods that fail to meet emerging standards.

Companies are most frequently collecting data on environmental factors such as waste management (67%) and carbon emissions (60%). Labour standards and health and safety data also feature prominently, with 45% of respondents focusing on these areas.

The growing focus on ESG highlights the need for businesses to balance supply chain diversification with the increasing complexity of managing global operations. By integrating ESG considerations into their strategies, companies can address regulatory pressures, meet consumer expectations for sustainable products, and navigate the challenges of an evolving trade landscape.