Five years ago, research by the NYU Stern Center for Sustainable Business revealed that US public boards were largely unprepared to oversee critical ESG (Environmental, Social, Governance) issues, as few directors possessed the necessary credentials in areas such as climate, employee welfare, financial management, and cybersecurity. In 2023, significant progress has been made, though some areas remain lacking.

A review of 1,161 Fortune 100 board members in 2023, compared to 1,188 in 2018, showed that the percentage of board members with ESG credentials has doubled from 21% to 43%, and the number of ESG board committees has surged from 22 to 89. The proportion of board members with environmental and governance expertise more than doubled, from 6% each in 2018 to 13% and 15%, respectively, in 2023.

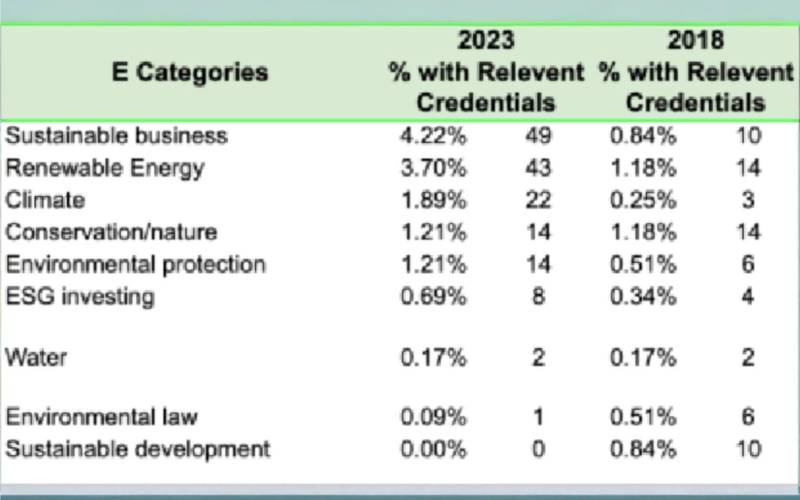

Social expertise, particularly in diversity, equity, and inclusion, remains the largest area of board expertise, growing from 80 to 108 board members according to the report. However, some areas such as health care, civil and human rights, and labor relations saw decreases in representation. Board members with environmental credentials also more than doubled, increasing from 10 to 49, while renewable energy expertise grew from 14 to 43, and climate change expertise expanded from 3 to 22. Despite these advances, water-related expertise remains stagnant, with just two board members having relevant credentials.

Governance expertise saw notable growth, with credentials in accounting oversight rising from 31 to 71 board members, and cybersecurity credentials expanding from 8 to 50. However, expertise in risk management, a critical area, remains underrepresented, with board members possessing risk credentials growing only from 5 to 11.

As ESG issues become increasingly vital for financial performance, companies can better equip their boards by recruiting directors with ESG experience, providing training in sector-specific ESG issues, integrating ESG considerations into board committees, setting up dedicated ESG or sustainability committees, and requiring executives to report on ESG key performance indicators (KPIs) and the financial impacts of ESG investments using tools like CSB’s Return on Sustainable Investment (ROSI) Methodology. This approach allows businesses to measure intangible metrics such as risk avoidance, employee retention, and operational efficiency, ensuring their boards are fit for purpose in the evolving ESG landscape.