A comprehensive study by Harvard Business School (HBS) researchers has revealed that nearly 900 publicly traded US companies are actively developing technologies to address climate change, marking a significant shift in corporate strategy. This activity has surged following the passage of the Inflation Reduction Act (IRA) in 2022, the largest climate policy in U.S. history.

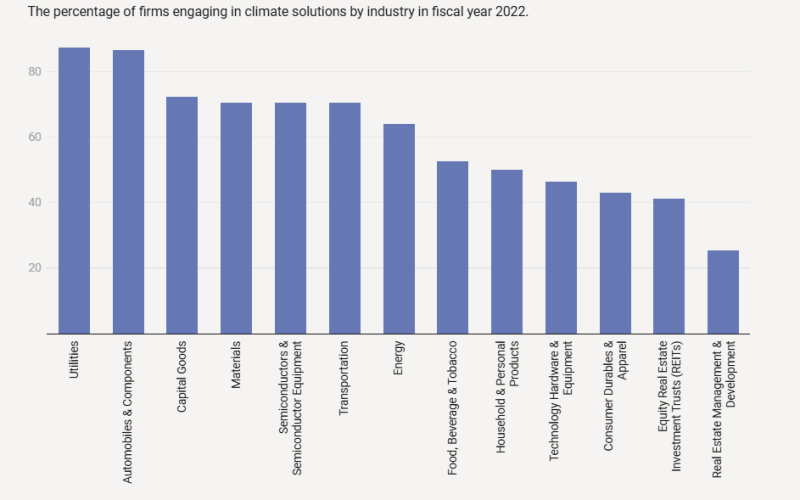

The research, led by Professor George Serafeim, Assistant Professor Shirley Lu, and Postdoctoral Fellow Simon Xu, analysed 39,710 annual financial filings submitted to the U.S. Securities and Exchange Commission (SEC) by 4,483 companies between 2005 and 2022. It found that 45% of companies in climate-relevant industries reported pursuing climate solutions in 2023, up from 20% in 2005. These companies, representing $8 trillion in market capitalisation and $6 trillion in combined revenue, are reshaping Corporate America’s approach to climate change as an economic opportunity rather than a risk.

The study identified 879 companies developing 88 climate solutions across sectors such as energy, technology, agriculture, and transportation. Initiatives range from installing LED lighting in Memphis to producing sustainable aviation fuel at United Airlines and nuclear power at Dominion Energy.

“This tells us that companies are serious about capitalising on the opportunity presented by the transition to a low-carbon economy,” said Serafeim.

The researchers also developed the BiGS Climate Innovators 100 list, highlighting firms delivering tangible climate solutions. Ranked first is SolarEdge Technologies, a leader in solar energy systems. Tesla and Sunrun, known for electric vehicles and residential solar installations, ranked second and third, respectively.

The IRA, signed into law in August 2022, is directing $369 billion into clean energy infrastructure and climate initiatives. Its impact is evident, with more than 42% of companies experiencing an increase in climate-related activity since the act’s passage.

First Solar, for example, plans to expand its U.S. solar panel manufacturing capacity by 8 gigawatts by 2027, citing increased demand driven by the IRA. Similarly, Ameresco, a renewable energy company, reported favourable business conditions for the sector due to the IRA.

The study highlights the economic weight of companies addressing climate change. Collectively, they represent roughly 20% of all U.S. market capitalisation. About 40% of these firms are headquartered in Republican-leaning states, demonstrating bipartisan economic motivation despite regional policy differences.

However, companies pursuing climate solutions face challenges. While these firms report higher revenue growth, they also incur higher costs, leading to lower short-term profitability margins. Nevertheless, their market valuations indicate investor confidence in long-term profitability.

The research highlights significant shifts across industries. For instance, General Motors (GM), ranked 25th, is transitioning from internal combustion engine vehicles to electric vehicles (EVs) while relying on traditional vehicle sales to fund its EV expansion. Similarly, Dow Inc. is investing in hydrogen projects and circular economy initiatives for plastics to reduce emissions and enhance competitiveness.

Companies like Bunge Ltd., a global agricultural commodities firm, and Xcel Energy, a utility provider, are also integrating sustainability into their operations. United Airlines, ranked 63rd, is investing in sustainable aviation fuel, which emits 85% less greenhouse gases than traditional jet fuel, despite high production costs.

Using artificial intelligence, the HBS team developed a model to analyse climate-related language in corporate filings. This tool provides a “climate solution measure” that ranks companies based on their contributions to climate innovation.

“This is a new tool to analyse American companies, but it is also a measure of the transformation of the U.S. economy to be competitive in the future,” Serafeim said.

The research offers crucial insights for policymakers, investors, and business leaders, revealing the transformative role of corporate America in addressing climate change. The findings demonstrate that Corporate America is increasingly recognising climate change as both a challenge and an opportunity, with profound implications for economic growth, innovation, and sustainability.

“The data tells us that the green transition is real, and we see almost every one of the country’s biggest industries changing,” Serafeim concluded. “The climate transformation is now a business imperative with implications for leadership, strategy, and finance.”