The European Central Bank (ECB) has concluded its Climate and Nature Plan for 2024–2025, further embedding climate- and nature-related risks into its core activities. Over the past two years, the ECB has refined how such risks inform policy decisions, strengthened banking supervision, and enhanced the management of its own portfolios and operations, reinforcing its mandate to safeguard financial stability in the euro area.

The ECB said climate and nature considerations are now more deeply integrated across its work. Within the monetary policy framework, the central bank has expanded the incorporation of climate and nature-related factors, including within the Eurosystem collateral framework, and has reduced the carbon footprint of its corporate bond holdings. Climate considerations, including transition policies such as Emissions Trading System 2, are now part of macroeconomic assessments and projections.

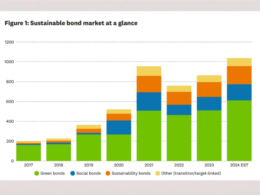

On data and risk analysis, the ECB has carried out and contributed to climate stress tests and scenario analyses, including the Fit-for-55 exercise, and is leading work on climate scenarios within the Network for Greening the Financial System. Updated statistical climate indicators, based on new methodologies and data, are improving the monitoring of sustainable finance trends, emissions reduction efforts and the impacts of climate-related physical hazards.

The ECB reported progress in strengthening banking sector resilience, noting that banks are now better equipped to assess climate and nature-related risks, supported by ongoing supervisory follow-up and, where necessary, binding decisions. The central bank has also continued to account for climate risks in managing its own balance sheet and operations, reducing emissions from its internal operations by 39% in 2024 compared with 2019, in line with its 2030 environmental targets.

Advancing work on nature has been another focus. The ECB’s updated monetary policy strategy now explicitly recognises the implications of nature degradation for monetary policy. Research conducted by the ECB highlighted the close interlinkages between nature and the euro area economy, with water-related risks identified as particularly material.

Looking ahead, the ECB said it remains committed to embedding climate and nature considerations across its work as the economic and financial consequences of climate change and ecosystem degradation continue to grow. It will intensify efforts in three priority areas: supporting the transition to a green economy, including assessing banks’ prudential transition plans; addressing the rising physical impacts of climate change through enhanced macroeconomic analysis and risk monitoring; and deepening analysis of nature-related risks, with a focus on water-related impacts.

These priorities will complement the ECB’s ongoing actions in monetary policy, banking supervision and financial stability, including the implementation of a climate factor in the Eurosystem collateral framework, further development of stress-testing methodologies, and continued improvements in climate-related data, indicators and disclosures.