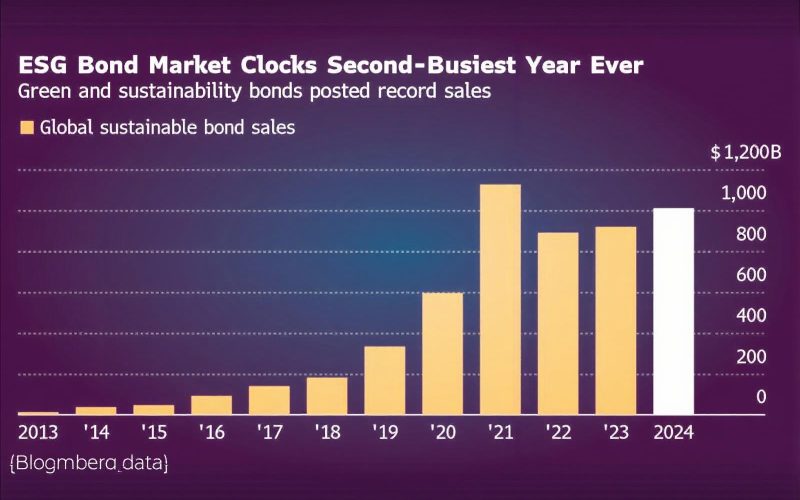

Annual global sustainable bond issuance surpassed $1 trillion in 2024, driven by record-breaking sales of green and sustainability notes. Wall Street sustainability chiefs anticipate continued demand for sustainable financing, even as a potentially less ESG-friendly Trump administration assumes office.

The $1.1 trillion raised through green, social, sustainability, and sustainability-linked bonds in 2024 marked a 10% increase from 2023 and the second-highest issuance since the market’s inception in 2007, Bloomberg data reveals. The record for sustainable bond sales remains $1.126 trillion, achieved in 2021.

A total of 4,490 offerings in 2024 set a new record, significantly surpassing the previous high of 3,729 in 2023. Green bonds, the largest sustainable debt category, reached $571 billion, eclipsing the $563.5 billion milestone of 2021. Sustainability bond issuance also hit a new high of $239.7 billion, up from the prior record of $235 billion in 2021.

Social bonds recorded their second-busiest year in 2024, while sustainability-linked bonds, often criticised for their flexibility, saw issuance decline for a third consecutive year, hitting its lowest level since 2020.