A new analysis from MSCI suggests that companies with higher ESG ratings may generate stronger investment outcomes in the Australian equity market, echoing global trends but with sector-specific nuances.

The study examined the MSCI Australia Listed 300 Index, ranking companies by their MSCI ESG Ratings and pillar scores. Companies were sorted into quintiles to compare performance, with the top-quintile firms benchmarked against the bottom-quintile group. The aim was to determine whether superior ESG performance translated into better equity market returns.

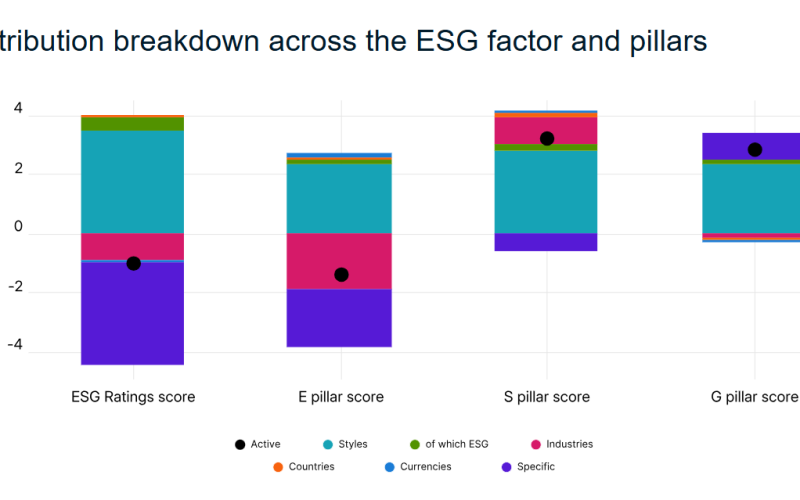

Using the MSCI Global Equity Factor Model, researchers found that equity style factors — including ESG — contributed positively to the returns of companies with high overall ESG ratings and strong environmental, social, or governance scores. Although the total active returns for the top ESG-rated companies were negative in some cases, this was attributed to specific industry exposures rather than ESG performance itself.

To refine their findings, MSCI delved deeper into the two most represented sectors in the index: materials and financials. By analysing sustainability theme scores within these sectors, they found that materials companies with strong ESG theme scores generally outperformed peers, except in the area of natural capital. In the financial sector, companies that excelled in social themes like human capital and social opportunities fared better, while those with high environmental and governance theme scores underperformed.

The findings underline the complex, sector-dependent relationship between ESG factors and investment returns. Despite mixed results across themes and sectors, the study supports the case that integrating ESG considerations into investment strategies can create long-term value in Australian equities.