By Dr Kaushik Sridhar – Founder & CEO, Orka Advisory (Melbourne, Australia)

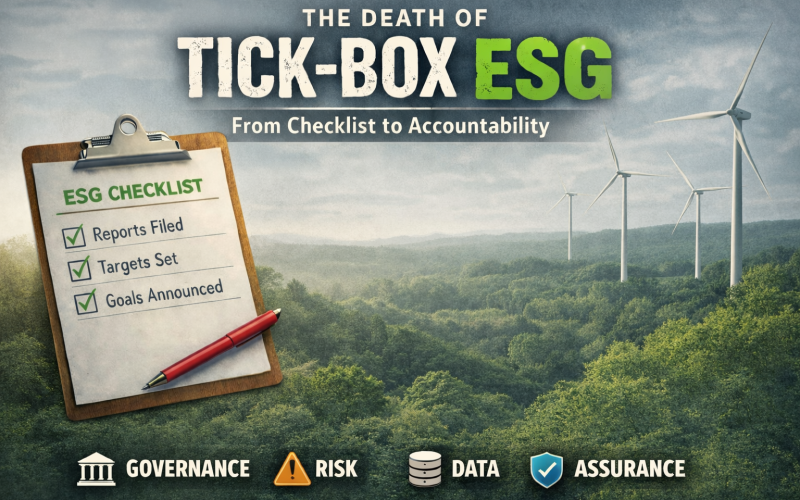

For more than a decade, ESG has existed in an uneasy space between intention and execution. Sustainability reports grew thicker, commitments more ambitious, and glossy claims more confident.

Yet behind the scenes, ESG was often peripheral to real decision-making – treated as a communications exercise rather than a core governance and risk discipline.

That era is ending.

A wave of global regulation is quietly but decisively killing off tick-box ESG. What is emerging in its place is something far more demanding: enforceable accountability embedded in governance, finance, risk management, and assurance.

This shift is not ideological. It is structural.

Why tick-box ESG survived for so long

Tick-box ESG thrived because it was largely voluntary, loosely defined, and weakly enforced. Companies could choose which frameworks to align with, what metrics to disclose, and how deeply ESG issues were integrated into strategy. Success was often measured by disclosure volume rather than decision quality.

Boards approved sustainability reports without interrogating assumptions. Executives delegated ESG to small teams with limited authority. Data lived in spreadsheets outside financial systems. Assurance, if obtained at all, was narrow and superficial.

In this environment, ESG rewarded storytelling over substance.

Regulation changes the rules entirely

The new generation of ESG and climate regulations fundamentally changes the logic of the system.

Mandatory disclosure standards are no longer asking whether companies care about ESG. They are asking whether organisations can prove how sustainability risks and opportunities affect enterprise value, financial performance, and long-term resilience.

Crucially, regulators are no longer satisfied with narrative alignment. They are demanding evidence of governance, controls, and decision-useful data.

This is where tick-box ESG collapses.

You cannot “opt in” to accountability. You either have the systems, or you don’t.

ESG is becoming a governance test, not a values statement

One of the most profound shifts is the repositioning of ESG from a sustainability conversation to a governance one.

Boards are now expected to demonstrate oversight of ESG risks in the same way they oversee financial, operational, and legal risks. This includes:

- Clear accountability for ESG-related decisions at board and executive level

- Integration of ESG risks into enterprise risk management

- Evidence that climate and sustainability considerations inform capital allocation, strategy, and remuneration

- Robust challenge processes, not just approvals

This is uncomfortable for many boards because it exposes gaps that glossy reports previously concealed. Governance cannot be retrofitted at the reporting stage.

Data is the new fault line

If governance is the first fault line, data is the second – and more dangerous.

Tick-box ESG relied heavily on qualitative statements, proxy metrics, and estimates that were rarely stress-tested. Under regulatory scrutiny, this approach is no longer defensible.

Regulators and investors now expect:

- Clear methodologies for ESG metrics

- Defined data owners and controls

- Consistency across sustainability reports, financial statements, and public claims

- Audit-ready documentation and traceability

This exposes a hard truth: many organisations simply do not know where their ESG data comes from, how reliable it is, or whether it can withstand assurance.

The result is a growing gap between what companies say publicly and what they can substantiate privately – a gap regulators are increasingly willing to challenge.

Greenwashing risk has evolved

This is why greenwashing is no longer primarily a marketing problem.

The most significant greenwashing risks today arise from weak governance, poor data controls, and internal inconsistencies. A sustainability claim does not have to be intentionally misleading to be legally problematic. If it cannot be supported by systems, evidence, and oversight, it becomes a liability.

Regulatory enforcement actions are increasingly focused on:

- Claims that overstate maturity or progress

- Targets that are not supported by credible transition plans

- Disclosures that conflict with internal risk assessments or financial assumptions

- Inconsistencies across annual reports, sustainability reports, investor presentations, and websites

In short, greenwashing has become a systems failure, not a communications failure.

ESG accountability is moving into finance and risk functions

Another clear signal of the death of tick-box ESG is where accountability is shifting internally.

ESG oversight is increasingly moving into finance, risk, and audit functions – not because sustainability teams have failed, but because the nature of the task has changed.

Mandatory reporting, assurance readiness, scenario analysis, and transition planning require disciplines that sit at the heart of corporate control environments. This is forcing organisations to rethink operating models, resourcing, and capability.

ESG is no longer a parallel track. It is becoming part of core business infrastructure.

What real accountability looks like

As tick-box ESG fades, organisations that adapt successfully share common characteristics:

- ESG risks are treated as enterprise risks, not reputational side issues

- Boards receive decision-focused ESG information, not just descriptive updates

- Climate and sustainability assumptions are tested against financial planning

- Data governance frameworks are in place, with clear ownership and controls

- Public claims are aligned with internal evidence and assurance readiness

This is harder work. It requires investment, cross-functional collaboration, and uncomfortable conversations. But it also creates more resilient, credible organisations.

The end of ESG theatre

The death of tick-box ESG does not signal the failure of sustainability. It signals its maturation.

What is disappearing is ESG theatre – the illusion that reporting alone equals responsibility. What is emerging is a more disciplined, accountable, and consequential model, where sustainability is judged by decisions, not declarations.

For companies willing to make this shift, regulation is not a threat. It is a forcing mechanism that clarifies expectations and rewards substance over spin.

For those that are not ready, the message is simple: the checklist is gone. Accountability has arrived.